loading

5.2

Standard Rewards (CL)

These are the Consensus Layer rewards for activating a validator that performs its Proof-of-Stake duties. All validators get this reward, whether solo-stakers, Rocket Pool minipools, or validators initiated from another protocol.

How is the amount of reward determined?

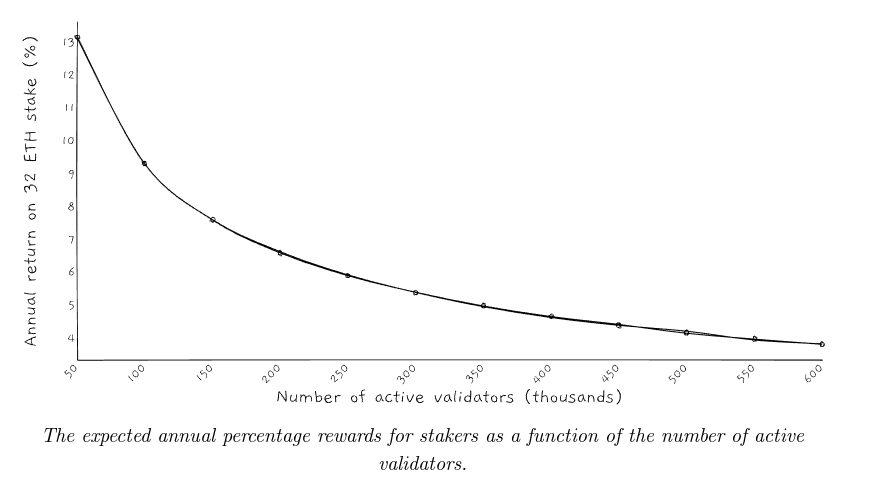

Issuance is the total amount of ETH given out as rewards for all Proof-of-Stake validating duties. It is pre-determined based on how much ETH is locked into the Beacon Chain deposit contract (or equivalently, how many validators are active).

The staking reward for an individual validator depends on issuance, how efficiently your validator performs and how many proposals/sync committees your validator has participated in.

The issuance, for reasons described in Ben Edgington's ethbook, is proportional to the square root of the number of validators. This means the yield given to N validators is proportional to as shown below:

As of this writing there are 650k validators leading to an APR of about 4%. Thus, for the standard 32 ETH deposit, a validator yields about per day. These accumulated rewards are skimmed (collected) every few days and sent to the address specified in the withdrawal credentials. Remember, for Rocket Pool, this is your minipool smart contract.

Claiming Standard Rewards

There are two ways to claim the rewards sent to your minipool contract and have them distribute to your Rocket Pool withdrawal address1:

rocketpool minipool distribute-balance.When these standard rewards are claimed, the funds are split and sent to the Node Operator and rETH contract, but not exactly equally. This is where the commission comes in...

1 Terminology reminder: withdrawal credentials is a field in the Beacon Chain deposit contract for a validator that says to send CL rewards to the minipool contract, whereas the withdrawal address is the address you receive the minipool contract distributions to (and can change as you please).